A digital solution designed to bring structure and consistency to the advisory process in insurance distribution.

We’re here to support insurance intermediaries in identifying client needs more clearly, documenting each interaction with precision, and building relationships that stand the test of time.

In practice, we designed DutyAdvisor to help you deliver smarter advice, follow up more effectively, and create a consistent experience—for your team and your clients alike.

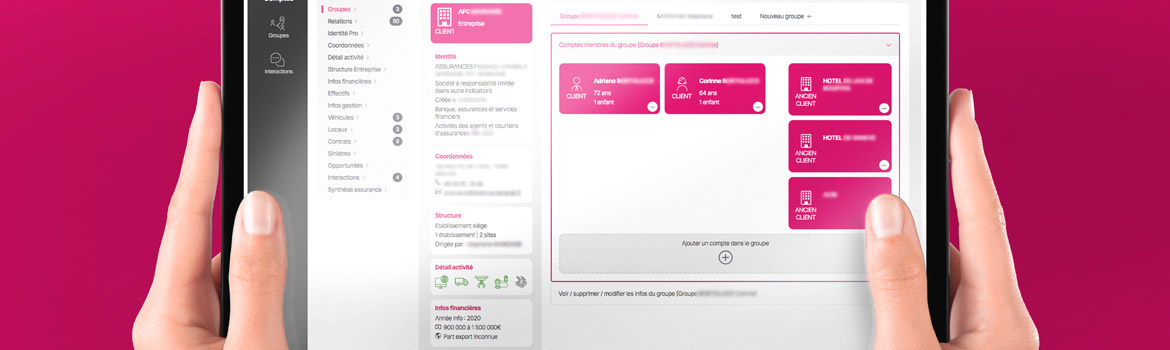

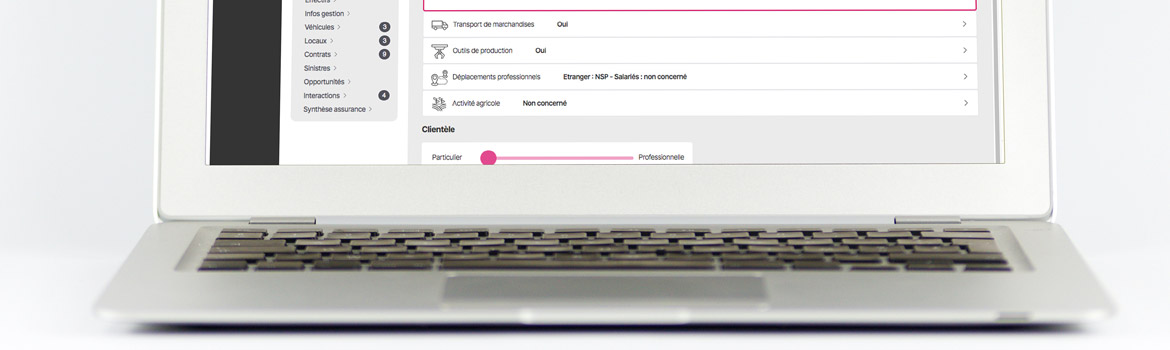

Built to fit seamlessly into your existing tools (CRM systems, broker platforms, company software…), DutyAdvisor naturally integrates into your daily routines. It supports you at every key moment in the client journey: annual reviews, prospecting meetings, inbound calls, or major life changes.

At each interaction, it generates a personalized summary, tailored to the client’s profile and available data.

It also offers message templates for client follow-ups and simplifies admin tasks—so nothing slips through the cracks.

With AI-powered features, you save time, reduce repetitive work, and stay focused on what really matters: giving high-quality advice and growing your business.

We know compliance is only getting more demanding. That’s why we built DutyAdvisor to protect your practice with full traceability—aligned with, and often going beyond, regulatory requirements.

Ready to take action?

Let’s talk about your priorities—simple, direct, no strings attached.

Key Use Cases for DutyAdvisor

Client annual review

Prepare your meetings, gather key info with structure, and generate a compliant advisory summary.

Life event or situation change

Evaluate the impact of personal or professional changes (birth, marriage, move…) and produce a tailored, professional response.

Prospecting interviews

We designed DutyAdvisor to guide you in identifying key client data—personal details, assets, future plans—and to help you structure conversations with prospects so you can uncover all their needs.

Why do insurance intermediaries need DutyAdvisor?

Agents and brokers represent an essential link in insurance distribution.

DutyAdvisor delivers tangible, measurable benefits:

- Greater transparency and improved risk management

- Stronger compliance with evolving regulations

- Smoother, more personalized client relationships

- Time savings through data centralization and reduced double entry

- A clearer, augmented client view, unlocking new commercial opportunities

DutyAdvisor is the go-to business tool for securing your advisory duty, structuring interactions, strengthening client relationships—and growing your practice.

Why choose DutyAdvisor?

We’re not here to change your job.

We’re here to equip it—better.

Because you’re at the heart of the client relationship.

Because you shouldn’t have to choose between commercial performance and regulatory compliance.

Because it is possible to combine efficiency, integrity, and simplicity.

DutyAdvisor helps you turn every client meeting into added value—for them, for you, and for the entire insurance chain.

Join those who are moving insurance distribution forward—practically, positively, and professionally.